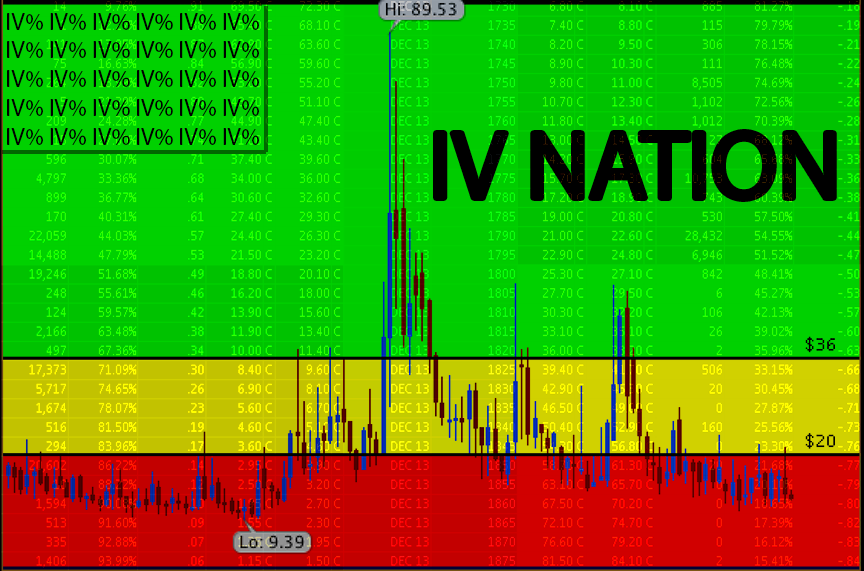

What a crazy run in twitter. 11/7 twitter opened to the public up over 100%. Over the next 13 days twitter lost 20% of it stock value. The next 13 days it went on a 55% run. a 3 day pull back of 10% and then another 5 day run for another 36%. On that 5 day run implied volatility went from 60% to over 120%. from the lows of 11/25 to the peak of 12/26 the stock was up a little over 90%. On 12/26 there was huge amounts of call buying with IV stretching 140%! With this amount of huge premium and dramatic stock move, it seemed only appropriate to sell lots of premium! As you can see the next day IV got crushed as well as the stock price. Hopefully IV will remain elevated and see more two sided markets in twitter for 2014, this could be a great trading vehicle for some time.

December 28, 2013

December 11, 2013

December 3, 2013

December 2, 2013

November 27, 2013

November 21, 2013

HFT

flash crash in WTM. Took out about the last 6 months trading range in 1 min and right back up...

nothing to see here folks

November 20, 2013

sounds right

how about we drug test all politicians. I mean we subject pro athletes to random drug tests and they just play games. These people run our country...

November 19, 2013

full steam ahead!

Yesterday I posted about bill dudleys comments and was pretty confused as to why he thought things would magically get better considering it hasnt worked for 5 years.

now I know why... just another $1.5 trillion of asset purchases over the next year, 50% increase over previous QE. there is no way the fed can stop. They have backed themselves into corner.

now I know why... just another $1.5 trillion of asset purchases over the next year, 50% increase over previous QE. there is no way the fed can stop. They have backed themselves into corner.

November 18, 2013

bill dudley

"while growth in 2013 has been disappointing, I believe a good case can be made that the pace of growth will pick up some in 2014 and then somewhat more in 2015." Keep praying bud. You guys have predicting that for 5 years, as GDP keeps getting lowered. markets up 170% since 09, 25% this year. But dont worry, it will pick up soon. we hope. or not

bitcoin mania

bitcoin has gone parabolic! loss of faith in fiat currency or just momo chasing dummys? It would be nice to see bitcoin succeed.

double POMO

The markets are so strong on fundamentals, that the fed needs to pump money into the markets TWICE today! Just another 5 billion of funny money.

November 17, 2013

ups-fdx pairs trade

Im looking at a pairs trade between ups and fdx. They have a high correlation and fdx IV% is over 80%. Im buying 100 deltas of ups and selling dec 145 calls against it. Have to sell 3 calls to equal out the deltas. The best case scenario. ups goes up, fdx goes down, fdx vol contracts.

November 15, 2013

HFT

HFT running the markets. This took place in 1 minute. Pfizer has a $200 billon market cap, this is not a penny stock. This happens all the time. Does not matter how big or liquid the product is. There is an illusion of liquidity.

October 2, 2013

September 24, 2013

September 20, 2013

FB!

Some weird HF trading on the close, seems to be news combined with rebalancing for expiration.

Blackberry hammered again today, down 20%.

The Dow closed below the fed day spike, although nasdaq and russell remain strong.

Weak close into triple witching, lets see if we can get some follow through this cycle.

Blackberry hammered again today, down 20%.

The Dow closed below the fed day spike, although nasdaq and russell remain strong.

Weak close into triple witching, lets see if we can get some follow through this cycle.

September 19, 2013

September 17, 2013

most important fomc meeting ever! again!

The MSM is buzzing about tapering tomorrow and reminding us over and over that this is the most important FOMC meeting ever. Although I heard that before about may 22nd, june 19th, july 10th, july 31st. august 21st, and now sept 18th. Let me remind you with some visual of how important these meetings have been.

Over the last 4 months we have traded mostly between 1685 and 1630, the range of the fomc meeting on may 22nd.

Just a reminder, markets up about 20% year to date with out a decent pull back. Also sideways action for the last 3 months. But I guess nothing matters any more when you have the Bernanke put.

August 27, 2013

Subscribe to:

Comments

(

Atom

)