|

| The Biotech ETF which was up just about 100% last year has pulled back 8% from all time highs. Its currently at its 50DMA. Some of the high flyers in there have started to crack. Ex. GILD |

|

| So far this is a very mild pullback of about 3%. Some of the untouchable nasdaq stocks from 2013 have taken some heat this week. |

|

| Bidu was sold pretty hard this week. While FB has been extremely strong lately moving as much as aapl in a day even though its 1/7th the size. |

|

| Brazil, Japan, and China have been beaten down this year. While the Russell remains up almost 2%. Still no fear in the US markets. |

|

| Metals and Miners have had impressive runs ytd. This was something I predict at the beginning of the year and I believe they still have plenty of room to run. |

|

| Coffee prices have risen 80% YTD. I expected coffee prices to rise, but this was much farther than I could have imagined! |

|

| 10 year yield has been trading in bull flag. I would expect to see increasing Yields but if the market sells off people might rotate to treasuries for safety. |

|

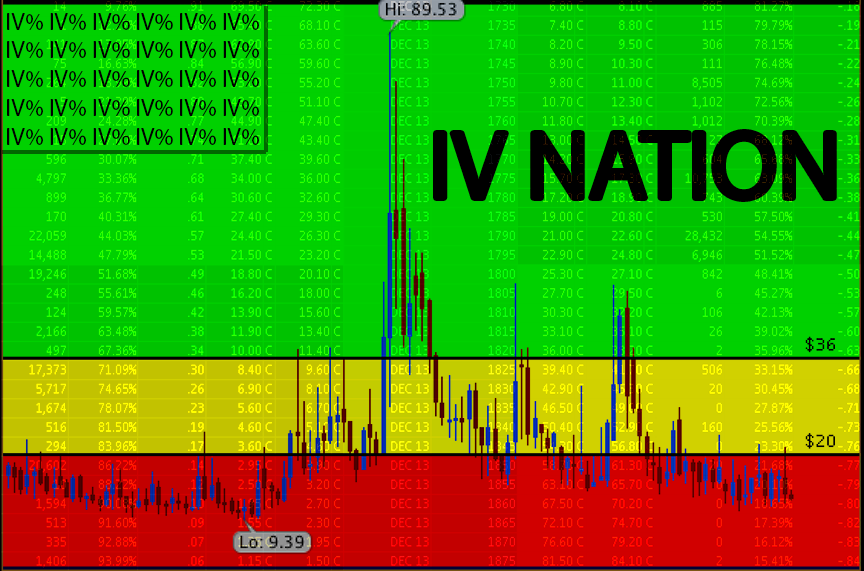

| Caught this screenshot on the way down. Happy trading and don't be the fool holding the bag. ;-) |