Volatility is back! Its the end of the month and DIA is down (5.25%) for January. A couple things that are making me believe there is a bigger correction on the horizon, more than we've already seen. The SPY is down a measly 3.5% for the year. This is the first time in over a year that the SPY has closed below the previous months open. In the last few days, aggressive rallies have been met with aggressive selling. Today the ES rallied 27 handles off earlier morning lows but the VX futures never went negative on the day. The VIX closed at 18.41, the highest monthly close since 2012. The VX futures are in backwardation. Feb VX futures closed higher than march, april, and equal to may. AMZN which has been a bulls wet dream was down over (10%) today on the back of bad earnings. AAPL is also down (10%) since earnings. To be fair, stocks that reacted well to their earnings were FB,NFLX,WYNN,CMG, and GOOG. But some of the stocks that never saw a downtick in 2013 are starting to crack and as i've mention before I believe this is a warning sign. Im long Silver and Coffee, Silver is stuck in the mud and can't seem to go either way, it's down (1.2%) YTD, but coffee is working nicely up 13.4%. You can see my reasons for coffee here. Coffee So far this year has been great with higher volatility and two way markets. Lets keep it up!

January 31, 2014

January 17, 2014

Jan Expiration

This week saw a little more volatility. The ES was down 30 handles on monday and by tuesday it had retraced most of that loss. The VIX futures had over a 1 point range on monday, which is a lot bigger than we have since lately. It shows a lot of people are probably under hedged and were dashing for some quick protection. Today is JAN expiration and the ES has traded in a 6 point range. I've noticed that some of the stocks that have been parabolic throughout 2013 are starting to crack. BBY, LULU, and GME all got hit hard this year. It seems the broad market is holding up for now, but I think these are the warning signs you have to pay attention to.

January 10, 2014

2014

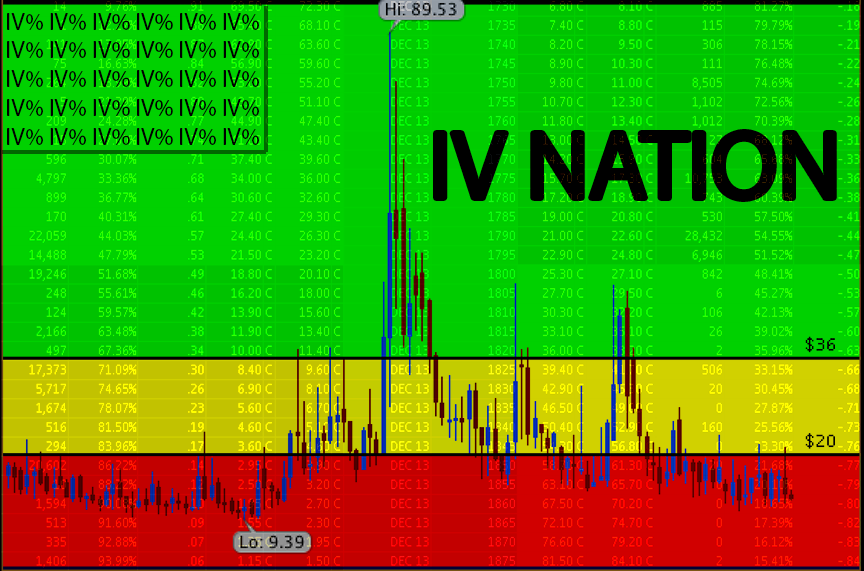

The first full week of 2014 is behind us and what a bore! The ES traded in a 25 handle range, with the VIX slumping back down to 12. Implied volatility is extremely low in all underlyings and its hard to find any decent premium to sell. Today was the "employment situation", we added 74k jobs, way under any of the estimates. Most products reacted the way I would have expected. Treasuries were up, Dollar down, metals up. The stock market initially sold of but continued to grind up the rest of the day, and closed the week green. Its seems the market is convinced nothing can go wrong. If there is bad news it just means the fed will do more, if theres good news, well then the economy is better. Its seems the market is way to complacent and participants are chasing high prices. For me, the more interesting plays have been commodities. I have been accumulating positions in SLV(silver), JO(coffee), and GDX(gold miners). They were all hammered in 2013 and seemed to be forming a base. These are longer term holds. Im selling calls against my positions to lower cost basis. What was interesting about todays # was metals rallied. That was something we never saw in 2013. Im hoping that this week wasnt a glimpse into 2014 future. I would love to see more two sided markets with some higher implied vol.

January 3, 2014

Coffee

I want to get long coffee. My reasons are technical and contrarian. Coffee has lost 75% of its value since may 2011. The monthly chart below shows the steep decline. Over the last three months it seems to have been stalling.

Subscribe to:

Posts

(

Atom

)