|

| Round trip ticket for the spoos, with a wicked rally off the open, by the end of the day it gave it all up. The interesting thing |

December 11, 2014

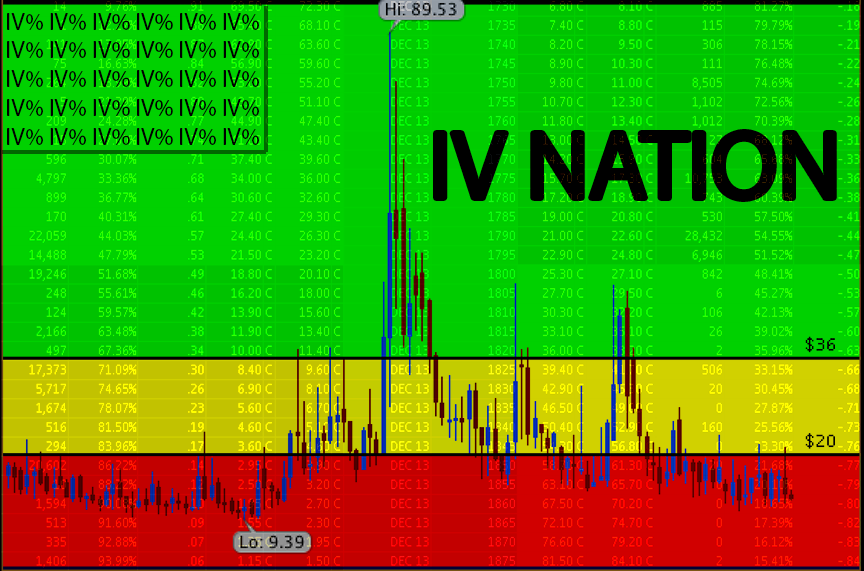

Strange Vix Movement

Its been an interesting week so far with Vix up 70% and SPX down less than 2%. It seems people were aggressively buying near term protection via VIX calls. The VVIX exploded as well today, with 75% of the Vix volume being Calls. It interesting because the Skew index is mid-range. So people buying near term vix calls instead of OTM puts. Something seems to be brewing under the surface, curious if some damage is starting to spread with Oil being down almost 50% in the last 6 months. There have been some strange thing going on lately, with the extreme upside spike in the Treasury market back on 10/15, the flash crash in AAPL on 12/1 and no bids for Oil. It will be interesting to see how the broad market holds up. It should be a pretty interesting friday.

Update on Oil

Oil is being dismantled, day by day, pulling the classic face plant. On that note gasoline is down to $2.23 by me. Lots of interesting moves happening under the surface, curious to see if there is contagion from this.

December 3, 2014

Bullish & Bearish Explained

There are six general terms used to describe market direction. The market terms bullish and bearish were assigned to market conditions based on how each animal was known to attack. A bull attacks by thrusting its horns in an upward motion, while a bear attacks with a downward swiping motion of the paw. Being bullish on a stock, or in the market in general, means you think it will increase. Conversely, being bearish means you believe the market will decline.

If you are actually investing in the market, you can either buy a stock and have a long position hoping the market goes up, or you could sell stock and be short, profiting on the margin if the market goes down. The latter is called short selling and allows investors to be profitable in a down market. To short a stock, you borrow it from another market participant and sell it in the market place. If, after you’ve sold it, the stock goes down, you can buy it back at a cheaper price and return it to the market participant you borrowed it from, while profiting from the margin.

Shorting a stock involves the same process employed to buy most stocks, but in the reverse. It is considered more risky to short a stock because of the unlimited upside risk, as opposed buying a stock that can only fall to zero. Over time, it tends to pay to be long or bullish, given the market’s slight but natural upward drift as a result of pensions, mutual funds, and 401Ks that cannot be shorted. Just remember the old stock market adage, "buy low and sell high" or "short high and cover low." Try not to get caught up in the hype, when a lot of people are making money really fast it could be a herd mentality and high risk.

Find more of my articles at www.top10beststockbrokers.com

May 8, 2014

IP(DOH)

After having some very impressive runs, these stocks are crashing and burning. Some ridiculous swings in the early stages of the public life.

March 19, 2014

Food inflation

March 14, 2014

3/14/14

February 27, 2014

The bulls have found the roids.

February 18, 2014

New highs.

February 7, 2014

First week of Feb

First week of February is done and there was some wicked volatility! The ES traded down to 1732 early wednesday and is closing out at the highs for the week at 1793! This morning the unemployment situation came in at 133k well below the consensus range. This caused some large moves in the indexes. The ES traded down over 1% and back up within 30 minutes. After having a horrible start to the year the NASDAQ is only down (.75%). The VIX got smashed today, losing just over 11%. The front month VIX future was hammered today losing (9%), the futures are now back to normal contango. The market was very strong this week and it is reminding me of buy the dip mentality of 2013. At this point the market still seems vulnerable and there are many thing different from 2013. Some difference are, the weakness in the dow/nikkei, the strength in bond/metals.

February 3, 2014

Ouch!

First trading day of the month, the SPY closed down (2.25%). The DIA is down (7.3%) YTD, thats ugly! The selling kept coming right up to the bell. Looking at the chart if we don't get some support here we could easily see 170 in the spy. The VIX was up 16.5% to 21.50. Coffee had a nice leg up again today, up 8.5% today and 24.25% YTD. Premium is getting juicy in a lot of stocks, I will be looking to sell premium once I see the momentum start to slow.

January 31, 2014

End of the month!

Volatility is back! Its the end of the month and DIA is down (5.25%) for January. A couple things that are making me believe there is a bigger correction on the horizon, more than we've already seen. The SPY is down a measly 3.5% for the year. This is the first time in over a year that the SPY has closed below the previous months open. In the last few days, aggressive rallies have been met with aggressive selling. Today the ES rallied 27 handles off earlier morning lows but the VX futures never went negative on the day. The VIX closed at 18.41, the highest monthly close since 2012. The VX futures are in backwardation. Feb VX futures closed higher than march, april, and equal to may. AMZN which has been a bulls wet dream was down over (10%) today on the back of bad earnings. AAPL is also down (10%) since earnings. To be fair, stocks that reacted well to their earnings were FB,NFLX,WYNN,CMG, and GOOG. But some of the stocks that never saw a downtick in 2013 are starting to crack and as i've mention before I believe this is a warning sign. Im long Silver and Coffee, Silver is stuck in the mud and can't seem to go either way, it's down (1.2%) YTD, but coffee is working nicely up 13.4%. You can see my reasons for coffee here. Coffee So far this year has been great with higher volatility and two way markets. Lets keep it up!

January 17, 2014

Jan Expiration

This week saw a little more volatility. The ES was down 30 handles on monday and by tuesday it had retraced most of that loss. The VIX futures had over a 1 point range on monday, which is a lot bigger than we have since lately. It shows a lot of people are probably under hedged and were dashing for some quick protection. Today is JAN expiration and the ES has traded in a 6 point range. I've noticed that some of the stocks that have been parabolic throughout 2013 are starting to crack. BBY, LULU, and GME all got hit hard this year. It seems the broad market is holding up for now, but I think these are the warning signs you have to pay attention to.

January 10, 2014

2014

The first full week of 2014 is behind us and what a bore! The ES traded in a 25 handle range, with the VIX slumping back down to 12. Implied volatility is extremely low in all underlyings and its hard to find any decent premium to sell. Today was the "employment situation", we added 74k jobs, way under any of the estimates. Most products reacted the way I would have expected. Treasuries were up, Dollar down, metals up. The stock market initially sold of but continued to grind up the rest of the day, and closed the week green. Its seems the market is convinced nothing can go wrong. If there is bad news it just means the fed will do more, if theres good news, well then the economy is better. Its seems the market is way to complacent and participants are chasing high prices. For me, the more interesting plays have been commodities. I have been accumulating positions in SLV(silver), JO(coffee), and GDX(gold miners). They were all hammered in 2013 and seemed to be forming a base. These are longer term holds. Im selling calls against my positions to lower cost basis. What was interesting about todays # was metals rallied. That was something we never saw in 2013. Im hoping that this week wasnt a glimpse into 2014 future. I would love to see more two sided markets with some higher implied vol.

January 3, 2014

Coffee

I want to get long coffee. My reasons are technical and contrarian. Coffee has lost 75% of its value since may 2011. The monthly chart below shows the steep decline. Over the last three months it seems to have been stalling.

Subscribe to:

Posts

(

Atom

)