January 12, 2015

January 4, 2015

Euro Weakness

December 11, 2014

Strange Vix Movement

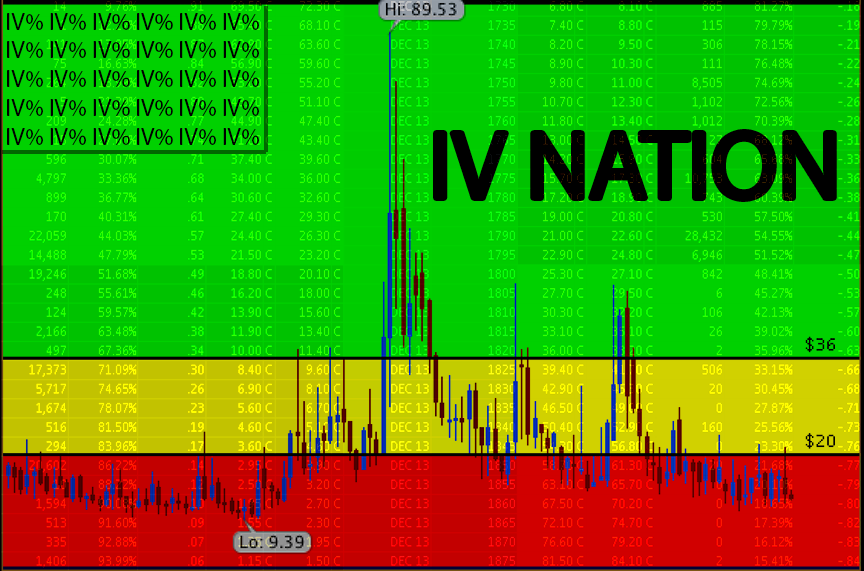

Its been an interesting week so far with Vix up 70% and SPX down less than 2%. It seems people were aggressively buying near term protection via VIX calls. The VVIX exploded as well today, with 75% of the Vix volume being Calls. It interesting because the Skew index is mid-range. So people buying near term vix calls instead of OTM puts. Something seems to be brewing under the surface, curious if some damage is starting to spread with Oil being down almost 50% in the last 6 months. There have been some strange thing going on lately, with the extreme upside spike in the Treasury market back on 10/15, the flash crash in AAPL on 12/1 and no bids for Oil. It will be interesting to see how the broad market holds up. It should be a pretty interesting friday.

|

| Round trip ticket for the spoos, with a wicked rally off the open, by the end of the day it gave it all up. The interesting thing |

Update on Oil

Oil is being dismantled, day by day, pulling the classic face plant. On that note gasoline is down to $2.23 by me. Lots of interesting moves happening under the surface, curious to see if there is contagion from this.

December 3, 2014

Bullish & Bearish Explained

There are six general terms used to describe market direction. The market terms bullish and bearish were assigned to market conditions based on how each animal was known to attack. A bull attacks by thrusting its horns in an upward motion, while a bear attacks with a downward swiping motion of the paw. Being bullish on a stock, or in the market in general, means you think it will increase. Conversely, being bearish means you believe the market will decline.

If you are actually investing in the market, you can either buy a stock and have a long position hoping the market goes up, or you could sell stock and be short, profiting on the margin if the market goes down. The latter is called short selling and allows investors to be profitable in a down market. To short a stock, you borrow it from another market participant and sell it in the market place. If, after you’ve sold it, the stock goes down, you can buy it back at a cheaper price and return it to the market participant you borrowed it from, while profiting from the margin.

Shorting a stock involves the same process employed to buy most stocks, but in the reverse. It is considered more risky to short a stock because of the unlimited upside risk, as opposed buying a stock that can only fall to zero. Over time, it tends to pay to be long or bullish, given the market’s slight but natural upward drift as a result of pensions, mutual funds, and 401Ks that cannot be shorted. Just remember the old stock market adage, "buy low and sell high" or "short high and cover low." Try not to get caught up in the hype, when a lot of people are making money really fast it could be a herd mentality and high risk.

Find more of my articles at www.top10beststockbrokers.com

May 8, 2014

IP(DOH)

After having some very impressive runs, these stocks are crashing and burning. Some ridiculous swings in the early stages of the public life.

March 19, 2014

Food inflation

Subscribe to:

Comments

(

Atom

)