|

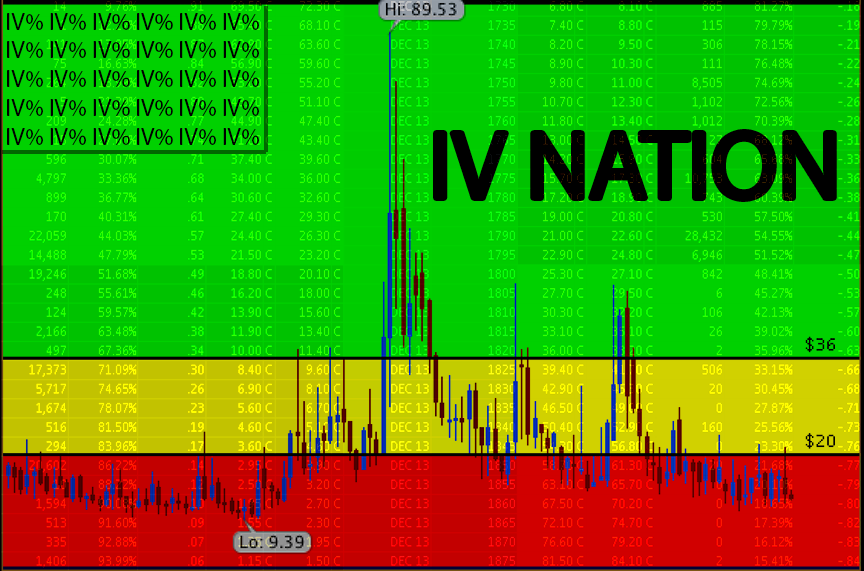

| Round trip ticket for the spoos, with a wicked rally off the open, by the end of the day it gave it all up. The interesting thing today though was the reaction the Vix had. |

|

| Less than 2% from fridays close to todays close. |

|

| You can also see the VVIX was exploding today. It seems to be the biggest weekly move going back to when it was introduced in march of 2012. |

| almost 75% of the volume today was Vix calls and now trading at 94% percentile of 52k week range. |