March 14, 2014

February 27, 2014

The bulls have found the roids.

February 18, 2014

New highs.

February 7, 2014

First week of Feb

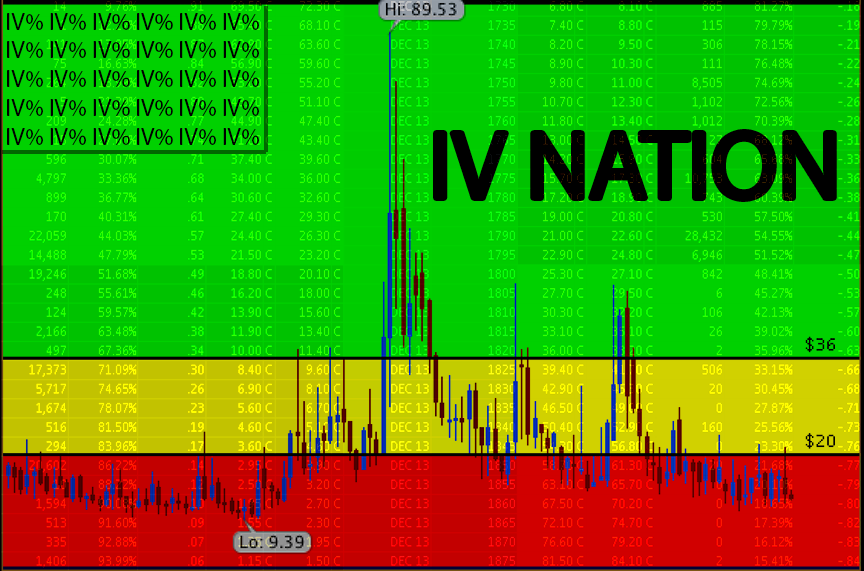

First week of February is done and there was some wicked volatility! The ES traded down to 1732 early wednesday and is closing out at the highs for the week at 1793! This morning the unemployment situation came in at 133k well below the consensus range. This caused some large moves in the indexes. The ES traded down over 1% and back up within 30 minutes. After having a horrible start to the year the NASDAQ is only down (.75%). The VIX got smashed today, losing just over 11%. The front month VIX future was hammered today losing (9%), the futures are now back to normal contango. The market was very strong this week and it is reminding me of buy the dip mentality of 2013. At this point the market still seems vulnerable and there are many thing different from 2013. Some difference are, the weakness in the dow/nikkei, the strength in bond/metals.

February 3, 2014

Ouch!

First trading day of the month, the SPY closed down (2.25%). The DIA is down (7.3%) YTD, thats ugly! The selling kept coming right up to the bell. Looking at the chart if we don't get some support here we could easily see 170 in the spy. The VIX was up 16.5% to 21.50. Coffee had a nice leg up again today, up 8.5% today and 24.25% YTD. Premium is getting juicy in a lot of stocks, I will be looking to sell premium once I see the momentum start to slow.

January 31, 2014

End of the month!

Volatility is back! Its the end of the month and DIA is down (5.25%) for January. A couple things that are making me believe there is a bigger correction on the horizon, more than we've already seen. The SPY is down a measly 3.5% for the year. This is the first time in over a year that the SPY has closed below the previous months open. In the last few days, aggressive rallies have been met with aggressive selling. Today the ES rallied 27 handles off earlier morning lows but the VX futures never went negative on the day. The VIX closed at 18.41, the highest monthly close since 2012. The VX futures are in backwardation. Feb VX futures closed higher than march, april, and equal to may. AMZN which has been a bulls wet dream was down over (10%) today on the back of bad earnings. AAPL is also down (10%) since earnings. To be fair, stocks that reacted well to their earnings were FB,NFLX,WYNN,CMG, and GOOG. But some of the stocks that never saw a downtick in 2013 are starting to crack and as i've mention before I believe this is a warning sign. Im long Silver and Coffee, Silver is stuck in the mud and can't seem to go either way, it's down (1.2%) YTD, but coffee is working nicely up 13.4%. You can see my reasons for coffee here. Coffee So far this year has been great with higher volatility and two way markets. Lets keep it up!

January 17, 2014

Jan Expiration

This week saw a little more volatility. The ES was down 30 handles on monday and by tuesday it had retraced most of that loss. The VIX futures had over a 1 point range on monday, which is a lot bigger than we have since lately. It shows a lot of people are probably under hedged and were dashing for some quick protection. Today is JAN expiration and the ES has traded in a 6 point range. I've noticed that some of the stocks that have been parabolic throughout 2013 are starting to crack. BBY, LULU, and GME all got hit hard this year. It seems the broad market is holding up for now, but I think these are the warning signs you have to pay attention to.

Subscribe to:

Posts

(

Atom

)